Table of Contents

- Introduction

- What Is Demonetization?

- India’s Economic Context Before 2016

- Announcement by PM Narendra Modi

- Immediate Reactions Across India

- Objectives of the Demonetization Policy

- Black Money and Tax Evasion

- Impact on Cash-Dependent Sectors

- Chaos at Banks and ATMs

- Digital Payments Surge

- Short-Term Economic Consequences

- Long-Term Effects on Indian Economy

- Political and Social Repercussions

- Global Reactions and Observations

- Conclusion

- External Resource

- Internal Link

1. Introduction

On the evening of November 8, 2016, Indian Prime Minister Narendra Modi appeared on national television to announce a stunning policy: from midnight onward, ₹500 and ₹1,000 banknotes—which constituted 86% of India’s currency in circulation—would no longer be considered legal tender. The move came suddenly, with little warning, and triggered a financial upheaval unlike anything India had seen in decades.

This bold step, aimed at combating black money, counterfeit currency, and terrorism financing, affected the lives of over a billion people, many of whom relied heavily on cash for daily transactions. It was not just an economic event, but a social shockwave that rippled through every layer of Indian society.

2. What Is Demonetization?

Demonetization refers to the act of stripping a currency unit of its legal tender status. It’s a rare and disruptive monetary measure usually undertaken to combat issues like hyperinflation, corruption, or to reset an economic system. In India’s case, the 2016 move was positioned as a bold anti-corruption initiative.

3. India’s Economic Context Before 2016

Prior to the demonetization, India had a large informal economy where transactions occurred primarily in cash. Tax evasion was rampant, and a significant portion of the nation’s wealth remained undocumented. The Reserve Bank of India (RBI) had been increasingly concerned about counterfeit currency and the hoarding of untaxed money—often referred to as “black money.”

4. Announcement by PM Narendra Modi

In his prime-time speech, Modi declared the discontinuation of ₹500 and ₹1,000 notes and urged citizens to deposit or exchange them in banks within a limited window. New ₹500 and ₹2,000 notes were to be introduced to replace the invalidated currency.

Modi emphasized that this drastic action was necessary to cleanse the economy of black money, end the circulation of counterfeit notes, and undermine terrorist networks funded by illicit currency.

5. Immediate Reactions Across India

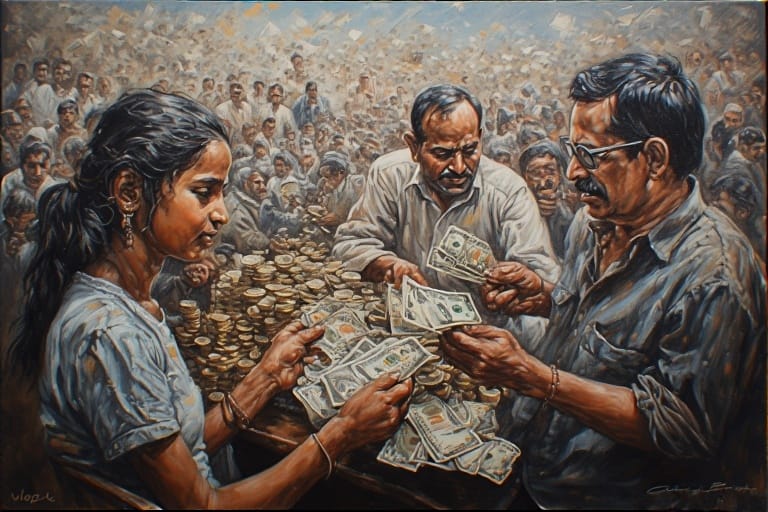

Overnight, millions rushed to ATMs and banks, trying to withdraw or deposit money. Long queues, confusion, and frustration became the norm. Many businesses, especially in rural areas, shut down temporarily due to lack of valid currency. Weddings were postponed. Farmers couldn’t buy seeds. Even hospital patients struggled to make payments.

While some citizens praised the move as patriotic and bold, others criticized the poor planning and lack of preparedness.

6. Objectives of the Demonetization Policy

The stated objectives included:

- Tackling black money hoarded in cash

- Ending the circulation of counterfeit currency

- Disrupting financing of terrorist activities

- Encouraging a cashless economy

- Widening the tax base by documenting previously unaccounted transactions

Though ambitious, these goals faced significant challenges during execution.

7. Black Money and Tax Evasion

One of the key targets of the move was black money—unaccounted wealth often used for bribery, tax evasion, and illegal deals. However, most black wealth in India was believed to be stored not in cash but in real estate, gold, or foreign bank accounts.

Surprisingly, over 99% of the demonetized currency eventually returned to the banking system, raising questions about how much illicit cash was actually flushed out.

8. Impact on Cash-Dependent Sectors

Sectors like agriculture, construction, and small-scale retail were hit the hardest. These sectors operated primarily in cash and were unprepared for such a sudden transition. Daily wage laborers lost jobs. Street vendors saw sales plummet.

The disruption extended to micro and small enterprises, many of which lacked bank accounts or digital infrastructure to adapt quickly.

9. Chaos at Banks and ATMs

For weeks, banks and ATMs were overwhelmed. Limits on withdrawals caused panic. People stood in lines for hours, sometimes days, to access their money. Tragically, reports emerged of over 100 deaths allegedly linked to the stress and chaos caused by demonetization.

Despite government efforts to print and distribute new notes, the transition proved slow and painful.

10. Digital Payments Surge

One unintended but notable outcome was the rapid surge in digital payments. Platforms like Paytm, PhonePe, and UPI apps saw unprecedented growth.

For a population previously reliant on physical cash, demonetization acted as a catalyst for digital adoption, especially in urban areas.

11. Short-Term Economic Consequences

India’s GDP growth slowed. Consumption dropped. Several informal businesses shut down. Agricultural markets were disrupted. The RBI’s annual report later confirmed the significant economic slowdown in the quarters following demonetization.

Critics argued that the economic pain was not justified by the modest gains in formalization or tax compliance.

12. Long-Term Effects on Indian Economy

Over time, some formalization of the economy did occur. The tax base widened, and more people began using digital platforms for transactions. However, critics contend that these gains could have been achieved without the human cost and economic shock.

The legacy of demonetization remains debated: hailed by supporters as a necessary sacrifice and condemned by opponents as a policy blunder.

13. Political and Social Repercussions

Politically, Modi’s popularity soared despite the hardship. His narrative of fighting corruption resonated with many. In subsequent elections, the ruling BJP (Bharatiya Janata Party) leveraged the move as proof of decisive leadership.

Socially, demonetization increased awareness about financial systems and taxes but also deepened distrust among those who suffered economically.

14. Global Reactions and Observations

Global economists and media outlets observed India’s experiment closely. Some admired its boldness; others questioned its rationale. The IMF acknowledged the potential long-term benefits but warned about the short-term disruptions.

India’s demonetization became a case study in universities and policy circles worldwide, analyzed for its execution, impact, and political framing.

15. Conclusion

The demonetization of November 8, 2016, was a watershed moment in India’s economic history. It shook the nation’s financial foundations and left a lasting imprint on how Indians perceive money, government, and digital finance.

While it failed to eliminate black money entirely, it succeeded in pushing the country toward a more formal and digital economy. Whether the cost was worth the outcome remains a deeply divided question.

What’s undeniable is that this event marked a bold—and controversial—attempt to reshape the Indian economy overnight.

16. External Resource

![]() Wikipedia – Demonetisation in India

Wikipedia – Demonetisation in India